![[INFOGRAPHIC]-Phones-Have-Changed-A-Lot.-Phone-Taxes...-Not-So-Much](http://lrmd-cpa.com/wp-content/uploads/2017/11/IFF_Phone_tax_512x850.jpg)

[Click image to enlarge]

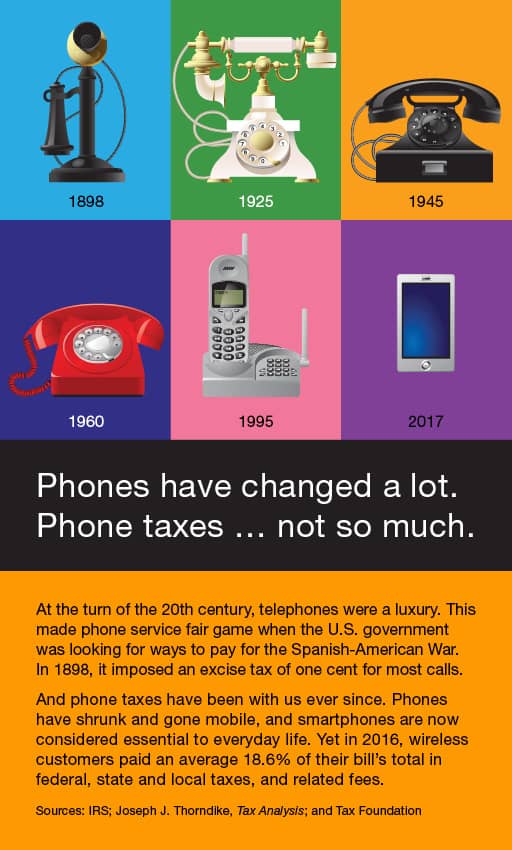

At the turn of the century, telephones were a luxury. This made phone service fair game when the U.S. government was looking for ways to pay for the Spanish-American War. In 1898, it imposed an excise tax of one cent for most calls.

And phone taxes have been with us ever since. Phones have shrunk and gone mobile, and smartphones are now considered essential to everyday life. Yet in 2016, wireless customers paid an average 18.6% of their bill’s total in federal, state and local taxes, and related fees. (Sources: IRS; Joseph J. Thorndike, Tax Analysis; and Tax Foundation)