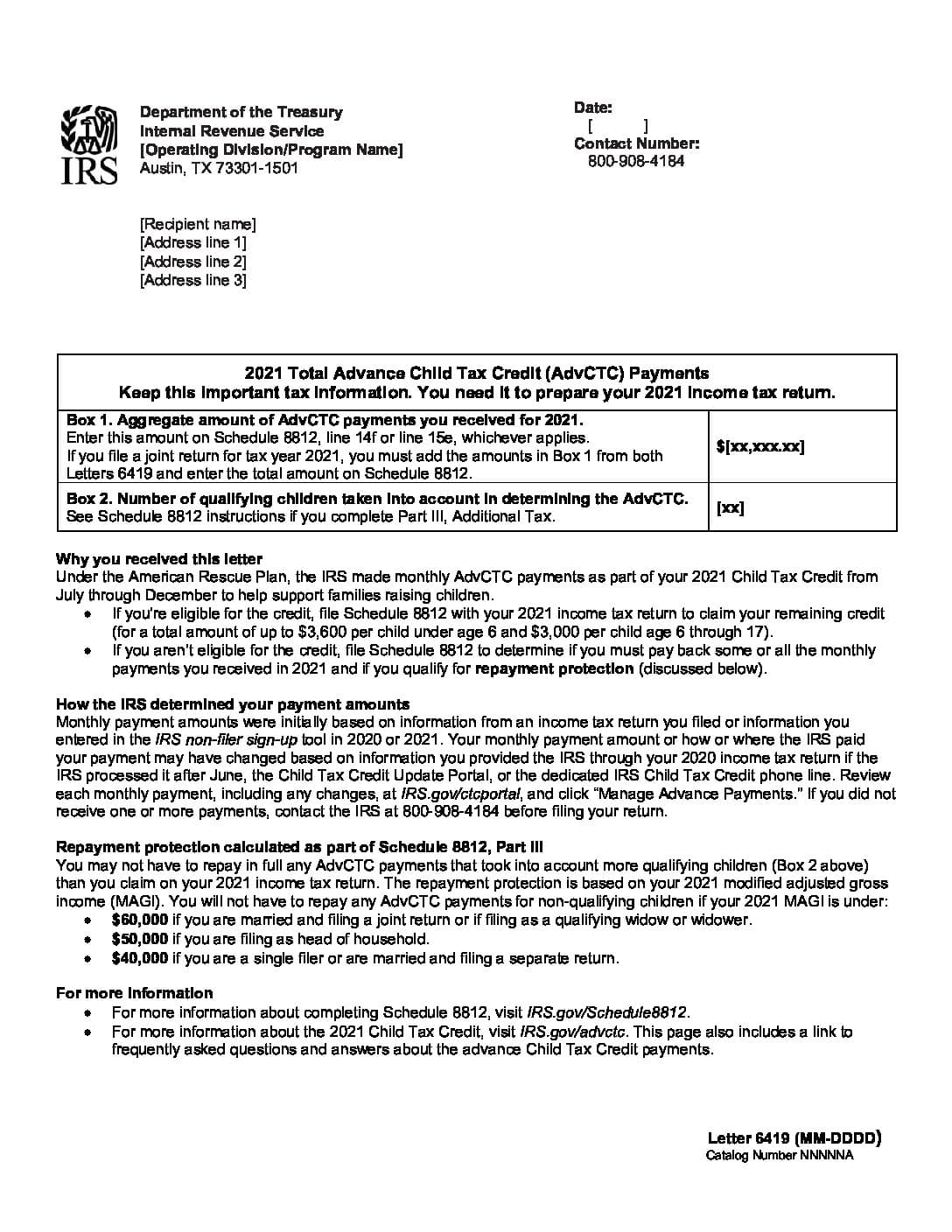

The IRS is sending out Letter 6419 to those who received advance Child Tax Credit (“CTC”) payments in 2021. This letter contains helpful information for your tax return preparation. If you receive this letter, please provide this to your tax preparer and retain a copy with your tax records.

We also recommend that you compare the advance payments stated in the letter with your own personal bank records.

Eligible families who didn’t receive advance child tax credit payments can claim the full amount of the child tax credit on their 2021 federal tax return.