What do Family Feud hosts and DCAA have in common? They both use surveys to find the best answers. While Steve Harvey exclaims “Survey says!?” during the hit game show to see if a contestant has found the best answer to a question, DCAA uses the Pre-Award Survey to determine whether a contractor has found the best way to document their accounting system and follow the appropriate policies and procedures. While the survey is often seen as just another compliance document by some government contractors, it can be a roadmap to a high performing company for all contractors. Instead of guessing what the number one answer to a question is, like on Family Feud, contractors can avoid the guessing game by looking to the Pre-Award Survey for hidden clues to building a stronger government contracting business.

Let’s identify what the Pre-Award Survey covers, and then circle back to how we can use this form to increase compliance and improve the overall performance of your government contracting business.

What is the Pre-Award Survey?

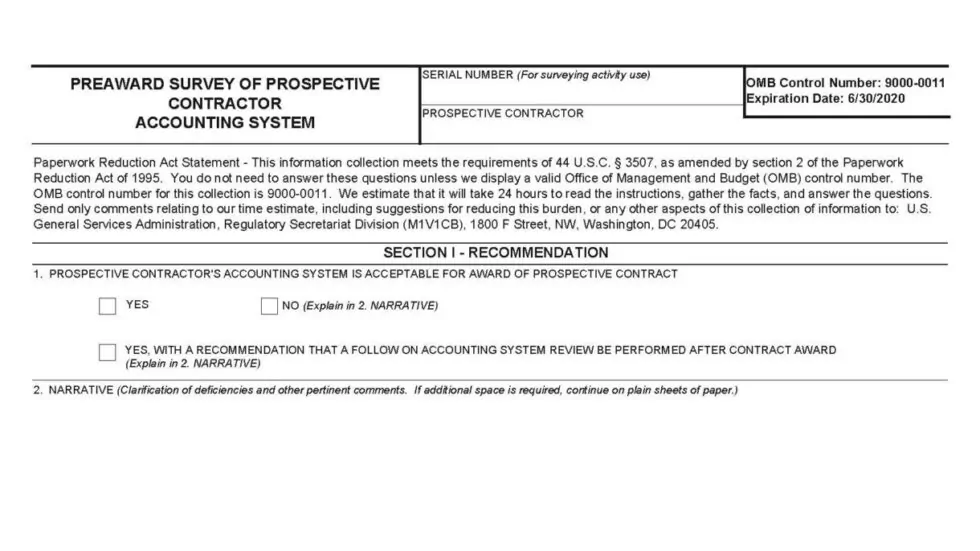

The Pre-Award Survey, documented on Standard Form 1408 (SF 1408), is a government form used to survey a contractor’s accounting system prior to the award of a cost-reimbursable contract. Results from this survey are conveyed in a report that the system is “acceptable” for use on the awarded contract. Surveys can be performed by the Defense Contract Audit Agency (DCAA) or an independent public accounting firm, assuming the contractor is comfortable with the CPA’s skills, knowledge and expertise in the government contracting industry.

It should be noted that this is not an actual audit of the contractor’s accounting system, which would have an objective of expressing an opinion on the subject matter, because the survey does not look at any actual costs – only the capabilities of the accounting system. It is referred to as a “survey” in the document but considered a “review” in public accounting terminology. While this can be performed on a system that is not yet implemented based on the software capabilities and the company policies and procedures manual, the system would ideally already be operational. What better way to demonstrate to the surveyor that your accounting system is operating properly than with an operational accounting system?

What does the Pre-Award Survey Cover?

While the survey is short in length, it covers some very fundamental accounting practices, which all government contractors should implement in order to make their accounting systems compliant and simultaneously improve the performance of their business. It contains requirements on the appropriate accounting method, cost allocations and allowability, as well as timekeeping, but does not expressly anoint a single appropriate accounting software. Therefore, the emphasis is on building a compliant system rather than implementing a sophisticated software package. In sum, the Pre-Award Survey largely outlines what accounting systems should be tracking and to what degree of detail.

The first item on the SF 1408 checklist in all capital letters, asks whether the accounting system is in accordance with Generally Accepted Accounting Principles (GAAP). The question, despite its simplicity, tends to be one of the most complicated items in which to comply. GAAP requires that revenue is recorded when it is earned, and expenses are recorded when they are incurred. In plain English, that means that revenue is recorded when the billable work is performed, not when the invoice to the government is paid in cash. Recording expenses when incurred means that a company must record the expenses when the services are provided, not when a check is sent to the vendor. For example, when a subcontractor performs work in December, but submits an invoice to the company in January, the expense will be recorded at the end of December rather than when the invoice is received and paid in January.

The tricky nature of compliance with GAAP is the often-necessary overhaul of a company’s accounting and recordkeeping procedures. When a business is established, business owners are concerned about how much money they have in the bank and how much they will owe in taxes at the end of the year. For this reason, accountants will typically begin keeping the books and records on a cash basis or a tax basis of accounting. Unfortunately for a government contractor’s purposes, this is the first bad habit that needs to be broken since this conflicts with the government requirements listed in the Pre-Award Survey.

The next item in the Pre-Award Survey outlines, in 10 sub-steps, the specific details required by the accounting system once it is operating in accordance with GAAP. One of the listed tenets of a compliant system, segregation of costs (namely direct and indirect), makes up most of Section 2. Direct costs are typically easy to identify and include direct labor, subcontractors, and other direct costs to name a few. Indirect costs include fringe benefits, overhead related to contract oversight, and general & administrative time linked to managing the overall business. While this is not all-inclusive, it provides a basic understanding of how the accounting system needs to segregate costs between what can be billed to the government and what must be allocated within the company’s indirect cost pools. The accounting system must be able to capture, and accumulate, these costs in the general ledger.

In addition to the general ledger, the costs also need to be allocated within a job cost ledger and a labor distribution report. A job cost ledger, a subsidiary to the general ledger, documents how the direct costs are being coded to each contract while the labor distribution report documents how the labor is being coded to a direct or indirect labor category. Not all accounting systems use the same terminology, but demonstrating that your payroll costs are being charged to the appropriate accounts as well as your direct costs being charged to the correct job will go a long way to demonstrate that the accounting system is capable of compliance with these rules.

In order to keep all this important information organized, the survey also inquires about the company’s consistency and logical methodology for allocating costs within the accounting system. A well-organized accounting system not only provides for a smooth experience when dealing with DCAA, but it also makes it easier to allocate costs to the appropriate cost objective, bill contracts, keep time, and create labor distribution reports. Furthermore, timely, accurate, and meaningful information also enhances management’s ability to make better-informed decisions to move the company forward.

To further highlight the importance of timely and accurate reporting of information, the survey inquires about the frequency of routine, interim determinations of costs charged to a contract, requiring a monthly minimum timing for reporting costs. For reference, a best-in-class business is reconciling their accounts on a monthly basis, if not more often, and recording their expenses to the appropriate accounts as they are incurred.

Direct and indirect costs are much of the focus during the survey, however, the survey also includes a line item on Federal Acquisition Regulation (FAR) Part 31 outlining costs that are considered expressly unallowable. In conjunction with the company’s ability to allocate costs to direct and indirect cost objectives, the company is also responsible for segregating costs that are expressly unallowable and not able to be recovered through the company’s indirect rates. Like with other costs, contractors need to demonstrate that their accounting system can identify these costs and keep them out of allowable indirect costs.

The last two items within section 2 of the survey deal with more detailed issues. The first, identification of costs by contract line item and by units if required by the awarded contract, allows DCAA to determine whether the contract invoices to the government are appropriate because the costs flowing to them will be allocated in the same way they are invoiced to the government. Second, segregation of preproduction costs from production costs is necessary because preproduction costs require a separate job for cost allocation. Again, these two items highlight the importance of organization and knowledge of your contract base.

There are three more steps to the Pre-Award Survey requiring documentation, but are made much easier if the tasks in section 2 are operating appropriately. These steps include whether the company can adhere to the clauses in FAR 52.232-20 and 21 (limitation of cost), in FAR 52.216-16 (limitation on payments), and can adequately develop reliable data for follow-on contract acquisitions. These clauses relate to the contractor’s ability to communicate timely with the contracting officer and the company’s ability to support requests for progress payments. If the company’s information is untimely or inadequate, the company is at risk of losing funding, not getting paid, or potentially not allowed to bid on subsequent contracts. The survey wraps up with a straightforward question whether the system is in operation, set up but not in operation, anticipated to be set up, or nonexistent. Unless a company is open to additional scrutiny and potential rejection due to insufficient records available for review, the only two viable options for selection are “in operation,” or “set up but not in operation.”

Why the Pre-Award Survey Matters

In general, government contractors need to overcome many more regulatory hurdles than their traditional commercial peers, but this is also what sets government contracting businesses apart. Successfully implementing changes listed in the Pre-Award Survey requires commitment from ownership, dedication from the accounting staff and a shared understanding of what the result will look like but has numerous short and long-term benefits.

- It calls attention to the need for organization, but more importantly, outlines specific ways to organize information in your accounting system that the government is expecting to see.

- Once processes are implemented, you have a more robust reporting system to keep you abreast of the company’s well-being and improve your ability to make timely, well-informed decisions.

- You are more qualified for future proposals. Proposal season is right around the corner, so looking at these items now will give you ample time to prepare to impress.

- It can help reduce stress when DCAA contacts your company to perform an audit or the Pre-Award Survey.

Regardless of the requirements applicable to your government contracts, you should consider the procedures laid out in the Pre-Award Survey to fortify your government contracting business. With companies in the midst of reconciling their 2019 books and records, and preparing for year-end taxes and financial statements, it is a great time to discuss these important areas with your CPA. Remember, it is never too late to start growing your business using the tools that are already available. Although creating policies and procedures is a time-consuming process, especially when beholden to government rules, it is a worthwhile endeavor allowing your business to bid on more work and produce more opportunities for employee and company growth.

Are you interested in learning more about how to grow your government contracting business but not sure where to start? Send us a message and we would be happy to walk you through next steps.

About the author:

Jason Mills, a partner at Lanigan, Ryan, has provided services to the government contracting community for more than 16 years. He has helped clients develop indirect rates, become compliant with the regulatory requirements imposed on government contractors and has interfaced with government audit agencies on behalf of his clients. He serves on the GovConNet Council of the Montgomery County Chamber of Commerce which focuses on issues facing government contractors in the DC Metro Area, and also on the Membership Committee of the Small and Emerging Contractors Advisory Forum (SECAF).

Lanigan Ryan is a team of CPAs, senior business consultants and associates specializing in the growth and development of privately-owned companies. As a result of working with Lanigan Ryan, government contractors are better equipped to prepare for DCAA, track indirect rates, prepare reliable bids, and make more informed decisions about moving their business forward.